Earlier this week, J.D. wrote about what he calls the biggest truth in personal finance: You can’t get rich through frugality alone. As Liz at Frugalwoods says, “You can’t frugalize income you don’t earn.” Income is one-half the fundamental personal-finance equation, and it’s probably the most important half.

J.D. advocates a three-pronged attack for boosting income: becoming better educated, becoming a more valuable worker, and learning to negotiate salary. But I think he’s missing a fourth important income source: the proverbial “passive income”.

I know, I know. Passive income has a bad reputation. Actually, passive income has a terrible reputation. And deservedly so. The Land of Passive Income is populated by scammers, hucksters, and charlatans. “Hey, little boy, wanna buy my course?” (Sorry, no links. They’re easy enough to find without us helping them.) That’s too bad because legit sources of passive income can be a great way to make more money.

What is Passive Income?

First up, let’s be clear: Actual passive “passive income” (as pitched by the scammers) is a lie. It doesn’t exist. When we talk about passive income, we’re talking about ways to make minimal money with minimal effort. Does that make sense? And it’s a supplement to your main income, not the primary source.

To me, passive income is money that’s earned, usually on a recurring basis, without a significant time investment.

For example, if you own a rental property that brings in $1500 each month, but only requires two or three hours of time to manage, that’s (mostly) passive income. Most nine-to-five jobs are the opposite of this. The income you earn is tied closely to the amount of time you spend at the office.

That’s not to say that passive income doesn’t require effort, though.

Often, there’s a lot of upfront work required before income can become passive. Using the same rental property example, before you can make any money, you have to purchase and renovate the property, and spend time advertising and interviewing potential tenants. All of that takes time and money.

Or, take J.D.’s book as an example. When I asked, he told me that he spent four months working full-time in 2009 and 2010 to write Your Money: The Missing Manual. That’s not passive! But he hasn’t touched the thing since then, and he continues to receive $50 checks every month. That is passive.

Passive Income Ideas You Can Try Today

Some degree of passive income is possible — and without shyster shenanigans. In this article, I’ve compiled 40 passive income ideas for you to consider. Not all of these passive income ideas will be right for you. In fact, maybe none of them will fit you. That’s okay. But I’m willing to bet that many GRS readers will find at least one source of inspiration here that they can use to help increase their income…even if it’s only a few dollars per month.

Pay Down Your Debt

Debt reduction isn’t the first thing that comes to mind for most people when they’re looking for ways to increase their income. But it should be.

Monthly payments on anything from high interest credit cards to expensive car loans can be a real drain on your bottom line. Sometimes the easiest way to improve cash flow is not to make more money, but to lower your expenses.

I recommend that you start by totalling up your debt, and then look for ways to pay it down more quickly. Depending on your situation, you might consider combining everything into one manageable payment, by taking out a consolidation loan. If you do have a large car loan payment, and are feeling stuck, you might be better off in the long run cutting your losses, and downgrading to a more modest vehicle.

(Need more help? Here’s our guide on how to get out of debt.)

Invest in a High Interest Savings Account

There’s no longer an excuse to have your cash sitting in a checking or savings account not accruing interest. These days, you can find a ton of online savings accounts offering a solid yield. Everything about this income is passive. In most cases, you can open an account within minutes from the comfort of your living room, have your funds transferred in, and start earning interest on your cash savings almost immediately. You won’t get rich with a savings account, but it’s a great way to get your emergency fund working for you. Here’s a list of some of the top savings accounts available today. Remember that rates are subject to change:

<!–

function getQueryStringVariable(variable) { var query = window.location.search.substring(1);

var vars = query.split('&');

for (var i=0;i

http://www.nextinsure.com/ListingDisplay/Retrieve/?cat=11&src=640942

Invest in Certificates of Deposit

If you are interested in earning a higher yield on your money than a savings account will offer, without the volatility that comes with stock market investing, a Certificate of Deposit (CD) can be a nice alternative that will earn passive income. CDs are commonly offered by banks and credit unions, and allow you to invest your money for a fixed time period, from just a few days to several years. Typically, the longer you lock in your money, the higher the return. CD yields should keep pace with inflation, with the downside being that you don’t have access to your funds on a day-to-day basis. What they do give you is a source of passive income without the risk.

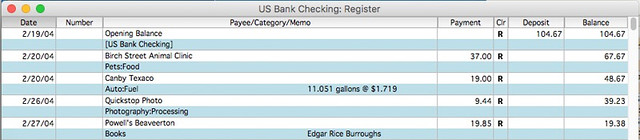

Earn Income in a Checking Account

Checking accounts are not known to be a place where you can earn income, that’s what savings accounts and other investments are for. But these days, there are a growing number of checking accounts that will pay you a tiny percentage yield on your balance. While it may only be a couple of dollars here or there, it can help to negate some of the other fees you might incur on your account.

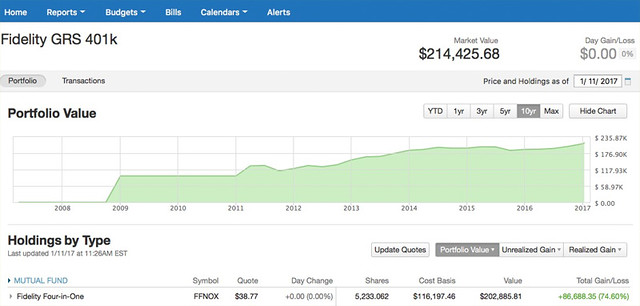

Robo-Advisor Investing

AI technology has reduced the amount of effort required to do so many things, including investing. You no longer need to meet face to face with an investment advisor to build a suitable investment portfolio.

Nowadays, you can sign up with a robo-advisor like M1 Finance or Acorns, and have a customized portfolio ready in minutes. From there, you’re on your way to building passive investment income. Of course, you’ll need to provide your robo-advisor with the pertinent details, such as your investment objective, risk tolerance, and investment time frame, but from there, your money will be invested in a hands off, low fee ETF portfolio that is automatically rebalanced on a regular basis.

Invest in Dividend Stocks

One of the ways publicly traded companies return value to their shareholders is in the form of dividends. One of the best ways to create passive income is by buying stocks that have a history of paying dividends. As the value of your investment grows, your dividend will also grow, creating a steady source of passive income.

If you stick with it long enough, you may earn enough to live off of the dividend income, while leaving your capital to appreciate in value as share prices rise. The combination of dividends and capital gains makes for a great 1-2 punch of passive income. With most discount brokerages like E-Trade and Charles Schwab now offering free stock trades, investing in the stock market has never been more affordable.

And here’s our introduction to dividend reinvestment plans.

Invest in a REIT

Real Estate Investment Trusts (REITs) are an easy and affordable way to invest in a well diversified real estate investment portfolio. The income from a REIT is even more passive than owning a rental property, because you don’t have the upfront work of finding tenants, not to mention the ongoing maintenance. A REIT is similar to a mutual fund, in that you purchase units of a REIT. Income comes in the form of profit earned by the REIT. Companies like Fundrise have made REIT investing even easier with their crowdsourcing approach, allowing you to get started for as little as $500.

Invest in artwork

This has got to be one of the more unique passive income opportunities on this list, and it really is passive. For centuries, the world’s most exclusive artwork has only been available to the wealthiest segment of society. But that is changing, with the help of companies like Masterworks. They source paintings by top performing artists, then issue a circular with the Securities Exchange Commission (SEC) to offer it to the public. Once this happens, you can purchase fractional shares of the painting, in essence owning a tiny piece of valuable artwork. Over time, when the artwork has appreciated in value, it is sold at a profit, with each individual investor receiving a percentage of the proceeds. One thing to keep in mind with this type of investment is that it is purely speculative, and relatively illiquid. In other words, you must be willing to part with your entire investment.

Peer-to-Peer Lending

Peer-to-peer lending, otherwise known as P2P lending, is an online platform that matches lenders and borrowers. Here’s how it works. Individuals, or in the case of a lender like Worthy, small businesses, borrow money from hundreds, even thousands of individual lenders, who have pooled their money together. Once the borrower repays their loan in full, the lender gets their principal investment back, along with interest. Because they lack the high overhead of traditional brick and mortar lenders, peer-to-peer lending companies are able to issue loans at lower interest rates, while providing better than average returns for investors. Here are a few of the more well known P2P lending companies:

Peer-to-Peer Lenders

Use a Rewards Credit Card

One of my favorite ways to make passive income is by using a rewards credit card. Every month, I run the majority of my spending through my travel credit card, which in turn earns points that I can use to pay for flights, hotels, car rentals, you name it. The card also comes with private airport lounge access, and a full suite of complimentary travel insurance.

Of course, credit card points will only benefit you if you are able to pay off the balance in full every month. If not, the interest you’ll pay will far exceed any points you’ll earn towards free travel or cash back. If you don’t already have a travel rewards credit card, or aren’t happy with yours, check out our handy travel credit card comparison tool.

Buy Vending Machines

Vending machines have been around forever, and they remain a tried and true way to earn passive income. You’ll need to check on your machines regularly and keep them filled with product, but otherwise there’s little to no work involved in the day-to-day operation. If you can find the perfect locations for your machines, it’s like having your own personal ATM. Vending machines can vary from a simple gumball dispenser, to a snack or soda machine.

Rent Your Space

If you have a spare room in your home, or an entire house you can make available to guests, you can earn passive income by renting out your space through sites like AirBnb and VRBO. This is a great way to get your property working for you, and for the most part, the income is passive. You don’t even have to worry about marketing, as the sites you list on will bring your customers to you. Your job is to decide when and how often you want to list, and that the space is clean and ready to accept guests.

Buy a Rental Property

There are a number of ways you can create passive income with real estate, one of them being to own a rental property. Often, the lowest barrier to entry is to keep your existing home as a rental when you move. Not everything about owning a rental property is passive, mind you. You’ll need to look after any required maintenance, and of course, screening potential tenants takes time. But if you can find a solid tenant for your rental, you should be able to sit back and watch the money roll in.

Here’s our guide to getting started with real estate investing.

Purchase a Self-Storage Facility

With the industry now approaching $40B, self-storage facilities have become a massive business in the US. While there is a large upfront investment required, if you have the resources, building or buying a self-storage facility can be a great way to earn passive income. The revenue is recurring as well, with most customers renting units on a monthly or annual basis.

Display Ads on Your Car

Did you know? There are companies that will pay you to wrap your car in advertising. If you don’t mind driving a billboard on wheels, Wrapify will pay you upwards of $100/week to display advertising on your car. The amount of passive income you’ll make will depend on how far you drive, and where you live. By connecting to an app on your mobile device, Wrapify can track your mileage as you drive.

Rent Out Your Car

The sharing economy has brought about plenty of side hustles that make it possible to earn money by letting others use your stuff. Take your car for example. If you have a late-model vehicle sitting in your driveway for hours at a time, you can make some extra cash by renting it out on an app like Turo.

Turo connects vehicle owners with people who need a car to drive, and are looking to avoid the high prices that car rental agencies charge. The nicer your car, the more money you can charge. The best part is that Turo does most of the heavy lifting, by bringing customers to you, and managing the payment and insurance component of the transaction.

Rent Out Your RV

Owning a motorhome is enough to stretch most people’s budget, but thanks to companies like Outdoorsy and RVShare, you now have the option of renting out your RV when it’s not in use. They connect you with renters via a mobile app, and you get to set the price, and the time period when your RV will be available. With an average rate of around $200/day, you could even make enough money to pay for your own RV adventures.

Rent Out Your Boat

If you own a nice boat, you can list it on sites like Boatsetter, and rent it out to someone who will use it for fishing, sailing, or watersports with friends. Depending on how passive you want this to be, you can choose to captain the boat, or leave it for your guests to manage on their own. Like RVs, boats are a luxury item that don’t often get used, making this an ideal passive income source. I ran a couple of searches on Boatsetter and GetMyBoat, and found rates in excess of $1000 for a full day.

Rent Out Your Stuff

We’ve covered cars, RVs, and boats, but the list of things you can rent out doesn’t end there. You can list cameras, tools, even sports equipment on a site like Peer Renters, and make money by renting them out to people who perhaps can’t afford to purchase the items outright, or just have a limited use for the item.

Sell Handcrafted Goods on Etsy

If you are crafty, you can sell your creations on Etsy, a massive online marketplace for handcrafted goods. Depending on the amount of labor involved in making your product, this might be a less passive form of income, but Etsy allows you to expand your reach beyond local craft shows. Whether it’s handcrafted jewellery, clothing, soap, or kids toys, Etsy places your creations in front of a global audience.

The former Mrs. Money Mustache uses Etsy to earn extra income.

Design and Sell T-shirts Online

Through marketplaces like Merch by Amazon, you can make your own t-shirt designs and sell them online. What makes this a great side hustle is that there is little to no upfront cost. You simply upload your designs, and Amazon fulfills your orders on-demand, including shipping. You earn a royalty for every shirt that’s ordered. All you need to do is come up with a great design that will sell.

Dave from Accidental FIRE designs and sells t-shirts online. (J.D. says he wants a few of these!)

Become a Rideshare Driver

If you have a decent car, enjoy driving, and don’t mind interacting with people, you can make decent money by driving for a rideshare company like Uber, or Lyft. One nice thing about this side hustle, is the flexibility. You choose when and how often you want to work. Of course, this income source isn’t purely passive. You’ll need to trade your time to make money. That said, there are plenty of jobs out there that are a lot more labor intensive than chatting with customers as you shuttle them around town.

Last year, our pal Josh Overmyer shared the pros and cons of becoming a rideshare driver here at GRS.

Get Paid to Shop Online

Websites like Rakuten (formerly Ebates) pay you to shop online. When you shop at your favorite retailers directly from the Rakuten website, you’ll earn up to 20% cash back, which is paid to you via a monthly check or PayPal. You can also redeem your rewards for gift cards to your favorite stores. Sign up for Rakuten, and start earning passive income while you shop.

Complete Online Surveys

Let’s be clear, no one will ever get rich by taking online surveys. In fact, there are a lot of scams out there that are nothing more than a complete waste of time. But if you have some time on your hands, and you just want to make a few extra bucks, online surveys can help. You can complete surveys while doing other things, like watching TV, or riding on the bus. Survey Junkie and Swagbucks are two of the more reputable sites out there.

J.D.’s girlfriend has tried online surveys. Her verdict? They’re fun and you can make some extra money while watching TV, but you won’t get rich with them.

Earn Songwriting Royalties

If you love to write music, you can create passive income by recording your songs and then publishing them through a variety of channels. You earn royalties anytime your music is played on streaming services like Apple Music, or Spotify, or played on the radio. You can even license your music for TV, movies, and videos without the backing of a major record label. Companies like Tunecore and CDBaby work with independent artists by publishing their music worldwide, then collecting and paying out any royalties that are due. This is a great passive income stream that can last for many years.

Purchase Music Royalties

Perhaps your talent isn’t to write music. That’s ok, you can still get into the music royalty game by purchasing the rights to song catalogues owned by other artists. Royalty Exchange is an online auction that allows you to bid on existing music catalogues. These are songs that are already earning regular, passive income for their current owners. When you purchase music royalties, you’re buying the future cash flow, which is purely passive income.

Photo Licensing

Photographers can build passive income by selling stock photos online. You’ll need to produce lots of content to earn a decent amount of money, but it can be a nice supplement to other, more labor intensive work, like wedding or family photography. One benefit to stock photo licensing is that you can sell the same pictures to many different buyers. There are no shortage of stock photo websites where you can sell your work. Dreamstime and Snapwire are just two of the more popular stock photo sites out there.

Record an Audiobook

One of the best ways for content creators to increase their income is by releasing their content in as many formats as possible. For example, if you’ve written a paperback book, or even an ebook, you’ll want to consider recording an audiobook version. There are no shortage of people who prefer listening to books instead of reading them. You can record the audio yourself, or pay someone else to do it for you. Once your audiobook is ready to go, it can be available for purchase online for years, making it the ideal passive income source.

Sign up for Sleep Studies

To some, this may seem like the dream way to earn passive income, no pun intended. Sleep researchers need test subjects for their studies, and it’s a gig that can pay very well. That said, it’s not as easy as it may sound. Often, participants are required to put on hold many of their daily routines ie. social media, extracurricular activities. If this is something you think you’d like to do in the name of science, you can begin by searching this government website for available opportunities.

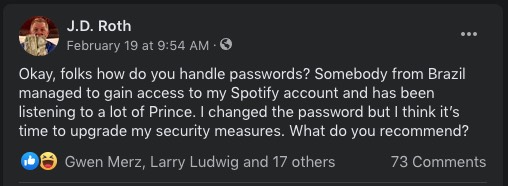

Sell Your Data

I’m personally not a fan of this passive income idea, because I value my privacy, but there are companies that will pay you to share your smartphone data with them. For it to work, you need to install an app on your phone that records your activity throughout the week. The money isn’t great, $5 or $10/month, but if you’re open to this kind of thing, it certainly qualifies as passive income.

Buy an Existing Website

If you prefer to start earning passive income instantly, you may want to consider purchasing an existing website or blog that’s already generating cash flow. This is a great way to get involved in an online business without having to build it from scratch. There are thousands of websites available for sale through online marketplaces like Flippa, and in many cases, these businesses are already producing a positive cashflow every month.

Of course, the more income they’re producing, the higher the purchase price. On average, you can expect to pay a 2-3X multiple on the annual income earned by the website. Also, it’s important that you do your research before you buy. Make sure the monthly income is stable, and that the potential is there for continued growth. Also, I recommend sticking with a niche that you understand, and have some expertise or prior knowledge of.

Buy and Sell Domain Names

Buying and selling domain names is a bit like trading on the stock market. The goal is to buy low, and sell high, but there can be some risk involved. There are people who earn good money buying domain names that they believe will increase in value over time, with the hopes of selling at a profit. If this sounds like a passive income strategy you’d be interested in trying, here are some tips on selling domain names for profit.

Of course, you could always be like J.D., who owns dozens of domains that he’ll never use. Silly man.

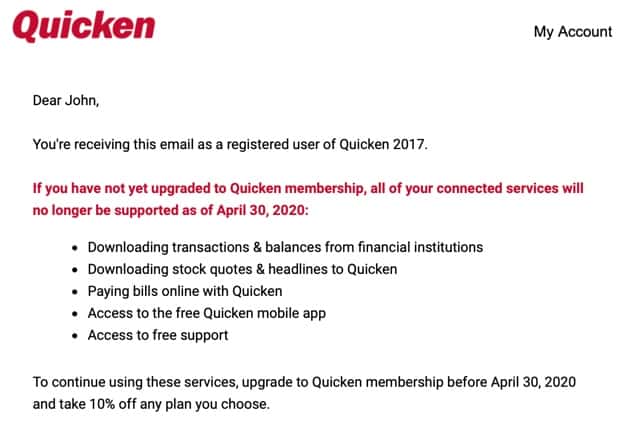

Start a Blog

Whenever I write about blogging as a way of making money, it’s usually good for a few raised eyebrows. It seems everyone is starting a blog, hoping to make money. Can it be done? Absolutely, but you need to be willing to play the long game.

Over time, it’s possible to create multiple passive income streams with a blog, through affiliate marketing, or display advertising, for example. But building a blog from scratch is anything but passive. You’ll need to be consistent in creating new content, and spend time promoting your blog. One of the best things about blogging is the low barrier of entry. If you have a computer and a wifi connection, you can get started for as little as a few dollars per month.

But maintain realistic expectations. Even this website doesn’t produce a full-time income at the moment!

Start a Podcast

It seems everyone has a podcast these days, and while many people do it out of pure enjoyment, there’s a lot of money that can be made. As you build a reliable following, you can begin selling advertising via sponsorships to brands that wish to get in front of your audience. Make no mistake, there’s a lot of work involved in finding guests and conducting interviews, but the opportunity to build a passive income stream is there. One way to reduce your workload is by outsourcing tasks to writers, podcast editors, and graphic designers.

Start a YouTube Channel

If you can consistently create videos that people want to watch, you can build an audience on Youtube. This is important, because with an audience, you can begin to make money, by joining the YouTube Partner Program. Most of your earnings will come from ads, which are aired within your video content, however, there are more ways to make money. YouTube can also drive traffic to your website and social media channels, making the passive income opportunities endless.

Sell Digital Products/Downloadables

Thousands of people earn passive income by creating digital products that people can download and use. From spreadsheets to productivity tools, calendars and checklists, the possibilities are endless. Once you’ve created your winning product, you can make it available for download on your own website, or through a third party platform like Gumroad.

Develop an Online Course

If you have expertise in a specific area, rest assured there’s someone out there willing to pay you for your knowledge. You can create an ebook on the topic, or develop an online course, and then sell it on your own website, or on an online learning marketplace like Udemy. No skill is too small to share with others. You could sell a course on creating a killer resume, starting a podcast, or how to travel hack a trip to Europe. With online courses, most of the hard work happens early on, when you’re creating the content. From there, with an effective marketing strategy, you’ll have yourself a nice, passive income stream.

When J.D. created his Get Rich Slowly course in 2014, it took several months of full-time work. But when he was finished, he had a nice source of passive income.

Run Website Display Ads

If you have your own website, you can sign up to have ads displayed within the content on your site. The most well known ad service is Google Adsense. Adsense displays ads that are relevant to your site content and that match your visitors preferences. When guests engage with an ad, you make money. Also, the higher your site traffic, the higher your income. What I like about display ads is that it really is passive income. Once your ads are set up, there is no work involved, leaving you to focus on what you do best, which is run a great website.

Affiliate Marketing

If you have your own blog or website, one of the best ways to make passive income is through affiliate marketing. Affiliate marketing involves promoting someone else’s product or service, and earning a commission whenever a sale is generated directly from your recommendation. The most well known affiliate program may be the one run by online retail giant Amazon, but there are thousands of other companies with programs of their own. Affiliate income takes time to build, but if you’re successful, it can be one of the best ways to make passive income.

Dropshipping

Dropshipping is a form of e-commerce where the seller doesn’t hold the product, instead, it’s shipped to the customer directly from the supplier. The seller’s job is to find products to buy at a wholesale price, and then sell them at the retail price, by advertising them through an e-commerce store, like Shopify. When orders are placed, they go directly to the supplier who ships the product to the customer. The seller profits from the spread between the retail and wholesale price. Dropshipping has become very competitive, but if you can find a product that people want, and sell it at a profit, there’s lots of passive income to be made.

Learn to Outsource

If you’re an entrepreneur, chances are you have a tendency to want to control all aspects of your business. After all, no one else understands it like you do, nor is anyone else as invested as you are. But the problem with doing everything yourself is that the money you make becomes anything but passive.

Many business owners burnout simply because they’re not willing to outsource tasks to others. These days, it’s easy to hire a virtual assistant, or other freelancers who can perform a wide variety of tasks. This frees up time for you to focus on doing the things that only you can do. Upwork and Fiverr are good places to start looking for freelance talent.

Final Thoughts on Passive Income

Back in 2007, when this blog was young, J.D. reviewed Don Lancaster’s 1978 book, The Incredible Secret Money Machine, a book loved by J.D.’s father. (The book is now available as a free PDF from the author’s website.)

The book’s premise is simple: Create a series of “money machines” that generate a steady supply of “nickels”. Although the book is overtly about creating small, hobby businesses, it covertly embraces the “passive income” mentality. Lancaster urges readers to create lifestyle businesses that require minimal effort to maintain.

I hope this list of passive income ideas can act as a source of inspiration for some of you seeking to build your own money machines. You won’t get rich with any of these suggestions, but you could find a way to produce a stream of nickels to supplement your income. That’s not so bad, is it?

There’s no shortage of ways to make passive income. What’s interesting, is that most of the ideas I’ve come up with are things that you can do online, from the comfort of your home. Of course, it’s important to remember that passive doesn’t mean easy. There can be weeks, months, even years, of hard work that goes into building an income stream. And sometimes your effort won’t pay off. (J.D.’s girlfriend tried to start an online business a few years ago. If it had worked, she would have had a stream of nickels. She only got pennies instead, so decided to shut it down.)

Passive income takes time and effort. But if you’re patient, the payoff can be worth the effort.

from Get Rich Slowly https://wordpress-374472-1172244.cloudwaysapps.com/passive-income-ideas/

via IFTTT